These companies offer some of the finest deals on Artificial Intelligence stocks, which are currently too excellent to ignore. Over the past year, artificial intelligence (AI) has intrigued the IT industry and sent numerous stocks flying. Artificial intelligence represents itself not a novel idea, though. So, why has it gotten so hot out of the blue?

Although computers are very good at processing data and performing mathematical tasks, they have only sometimes been able to perform tasks that require language, vision, or other natural human abilities. But AI fills that void, utilizing machine learning to finish jobs that usually take humans.

Thus, developments in AI have the potential to be advantageous for a variety of industries, including consumer electronics, driverless cars, education, health care, and others. And since AI is still in its early stages of development, the possibilities are endless.

Until 2030, the AI industry is expected to develop at an average yearly growth rate of 37%, reaching a valuation of around $2 trillion. Given the market’s enormous potential, investing now and taking advantage of AI’s long-term benefits may still be possible.

These three AI stocks are, therefore, excellent investments for April.

-

Intel

With Intel’s stock falling 27% from 2022, investing in the company has been complex in recent years. However, in the past year, the organization has made significant adjustments to its business plan that might make it a more alluring long-term choice for AI investments.

Intel is growing its market share by introducing its new range of Gaudi 3 artificial intelligence graphics processing units (GPUs). The processors announced earlier this month are said to be 40% more power-efficient and 50% better at inference than comparable Nvidia products.

Furthermore, by enhancing its processors’ artificial intelligence (AI) abilities, Intel is securing the top rank in AI by leveraging its long history of leadership and experience in central processing units (CPUs).

Intel will need time to grow its AI division and overtake competitors like Nvidia and AMD. However, according to the above trend, Intel might be the most inexpensive AI chip stock. Among these companies, Intel has the cheapest forward price-to-earnings ratio (P/E), which makes it a relative steal.

The company is currently too excellent to ignore, growing thrillingly.

-

Apple

Apple is more silent on the artificial intelligence side than many of its competitors. However, the business has a reputation for slowly implementing new technology. Apple is more renowned for improving current innovations with a unique design language than for inventing new ideas. The company attracted billions of consumers and eventually became the industry leader.

Before Apple’s arrival, several firms dominated markets, such as those for tablets, smartwatches, and Bluetooth headphones; however, with the introduction of devices like the iPad, Apple Watch, and AirPods, its rivals must be remembered. Therefore, the fact that Apple isn’t now among the leaders in AI should be manageable.

The tech behemoth is secretly improving its AI capabilities. Meanwhile, its dominant market shares across several consumer tech categories may help it lead the sector and become a significant growth engine for bringing artificial intelligence into the lives of regular consumers.

When Bloomberg revealed on April 11 that Apple was redesigning its whole Mac range to increase its capacity for artificial intelligence and satisfy the increasing demand for such technology, the company’s shares saw a minor spike. In the meantime, the tech giant has been progressively rolling out additional artificial intelligence (AI) features across its range of products, such as enhanced Siri on the iPhone and new watch movements.

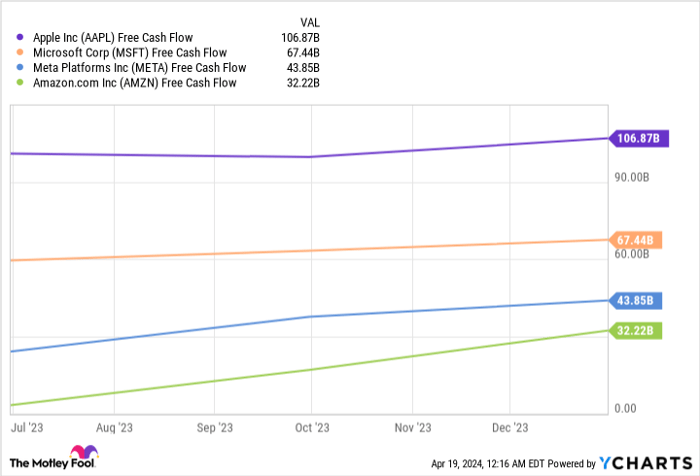

Apple produced around $107 billion in free cash flow last year, a significant amount higher than some prominent AI participants, such as Microsoft, Meta Platforms, and Amazon. According to this statistic, Apple has what it takes to grow in the emerging AI sector and eventually compete with its rivals.

At 25 times projected earnings, Apple’s stock is a compelling investment opportunity in artificial intelligence.

-

Alphabet

Cloud competitors Microsoft and Amazon have marginally outperformed Alphabet in the AI space over the past 12 months. For long-term returns, though, the company is unquestionably among the most promising AI stocks.

The corporation is the home of many influential brands, such as YouTube, Google, Chrome, and Android. With billions of customers constantly utilizing these services, Alphabet has plenty of opportunities to promote its artificial intelligence products.

The business’s recent decision to focus on this profitable market is encouraging. Alphabet introduced Gemini, its most sophisticated AI model, earlier this year. The model made several faults during its launch appearance, so it was not the best first impression. As a result, the company had to halt its picture generation services temporarily.

![]()

Alphabet is, nevertheless, making progress with its AI development. The company recently revealed plans to combine its Deep Mind and Research teams to increase productivity in its AI business. Alphabet plans to move its Intelligence-focused Accountable Artificial Intelligence division to Deep Mind, its model-building hub.

Regarding other AI equities, Alphabet’s shares are inexpensive, much like those of Apple and Intel. It has an appealing forward P/E ratio of 23, far less than Microsoft’s 34 and Amazon’s 43.

This month, Alphabet’s stock is an incredible deal you will be reluctant to pass up.