Cryptocurrency and Artificial Intelligence is a widely used phrase that refers to a fast-developing field in which machines are taught to acquire knowledge, process data, and make decisions with growing independence. In the realm of cryptocurrency, trading offers a pathway to profit for many. Some leverage crypto signals, powered by AI, to navigate the market’s complexities and maximize gains. The impact of this phenomenon extends well beyond the domain of science fiction, as it has entered various industries and drastically transformed our lifestyle, professional activities, and interaction with technology.

AI-driven diagnostics are being used in healthcare to diagnose diseases at an early stage and to develop individualized medication strategies. Similarly, AI algorithms are being employed in finance to streamline risk assessments and detect fraud in the traditional financial industry. Industries such as production and transportation are experiencing the significant effect of AI, as robots and autonomous cars are becoming more and more prevalent.

AI is making also considerable progress in the dynamic and innovative realm of cryptocurrency. Since the beginning of Bitcoin, the initial and well-recognized cryptocurrency, the realm of cryptocurrencies has been defined by its constant growth. There is a steady development of new blockchain protocols, with decentralized apps pushing the limits of what is achievable, and ongoing enhancements and modifications to the underlying technology.

This blog explores the exciting combination of two groundbreaking phenomena: the transformative impact of AI on the cryptocurrency ecosystem. We will examine different ways in which AI is influencing the cryptocurrency industry, including strengthening security measures, optimizing investment approaches, and facilitating a more effective and intelligent financial landscape. Through the analysis of individual instances, potential future uses, and fundamental factors, we will get a more profound understanding of this strong collaboration and its consequences for the cryptocurrency realm.

Impact Of AI On The Cryptocurrency:

Fraud Prevention:

Many benefits come with cryptocurrency’s decentralized nature, but it also brings a new problem: fraud. The cryptocurrency market is not always well-regulated, unlike more conventional financial systems. This can make it an attractive target for criminals. A summary of the main obstacles is as follows:

Pseudonyms: Problems with identifying and tracking bad actors arise from the fact that crypto transactions frequently involve users who use pseudonyms.

Irreversible Deals: Once confirmed on the blockchain, cryptocurrency transactions are permanent, unlike credit card transactions. This means that money lost due to fraud cannot be recovered.

Upcoming Methods of Fraud: Criminals are always thinking of new ways to take advantage of security holes in cryptocurrency platforms, storage services, and initial coin offerings (ICOs). Some examples of these include bogus investment platforms, pump-and-dump schemes, and phishing assaults.

AI: A Watchful Eye Against Deception

Thankfully, artificial intelligence is quickly becoming a potent tool in the battle against cryptocurrency fraud. AI approaches this challenge in the following way:

Detection Of Anomalies: Artificial intelligence systems can detect anomalies in user behavior by real-time analysis of massive volumes of transaction data. This feature enables the detection of questionable financial transactions, like those with unusually high amounts or those coming from addresses that are known to be blacklisted.

Models for Machine Learning: Artificial intelligence systems that have been trained with past data can figure out what signs indicate fraud. These models efficiently determine the probability of a fraudulent transaction by examining variables such as the frequency of transactions, their location, and the wallet’s history.

Network Analysis: Artificial intelligence (AI) can examine the cryptocurrency transaction network for red flags, such as suspicious connections or clusters of activity that could indicate coordinated attacks or money laundering.

Examples of Fraud Detection Solutions Driven by AI:

Some businesses have already begun using AI-driven solutions to fight cryptocurrency fraud:

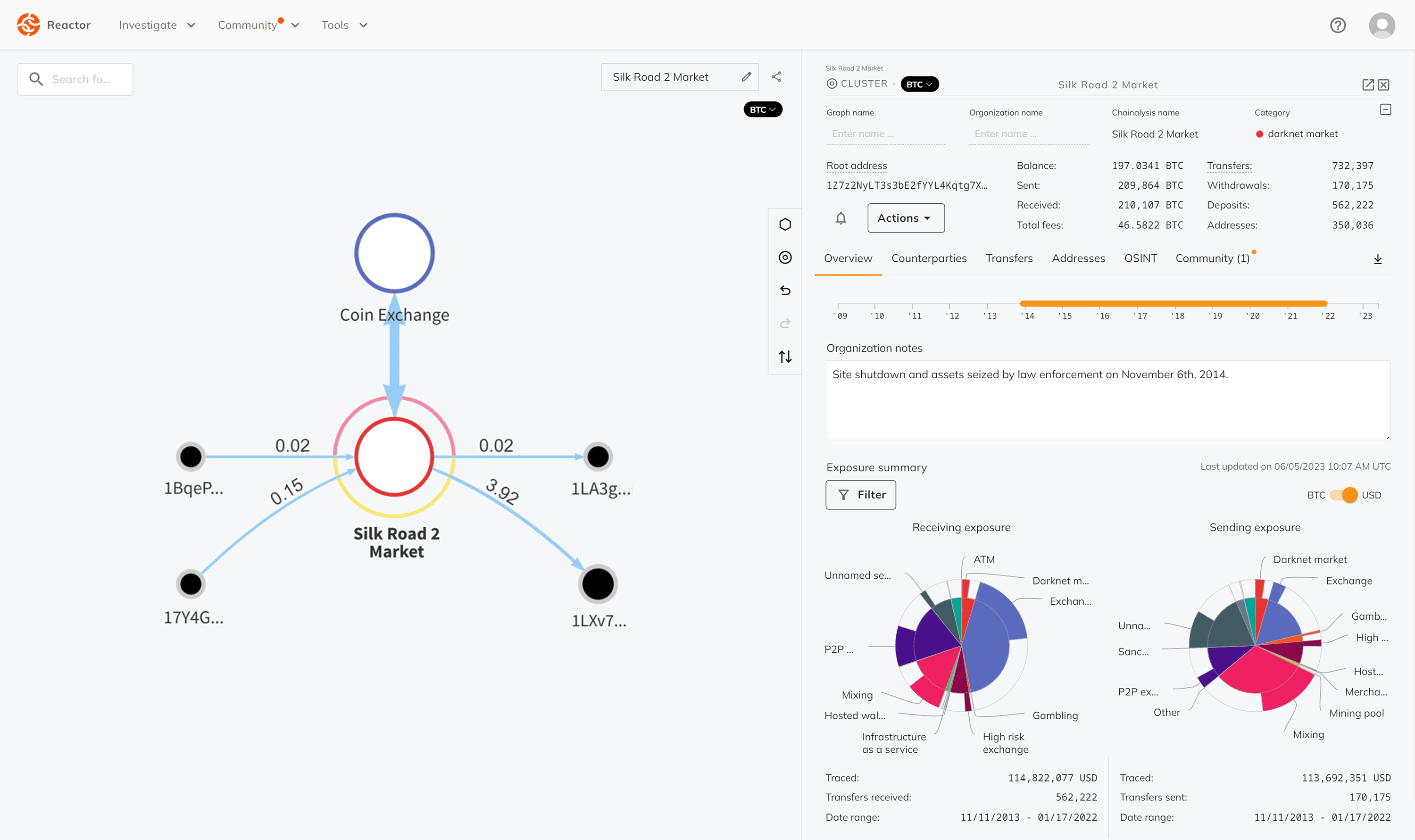

- Chainalysis: Using artificial intelligence (AI), Chainalysis’s blockchain intelligence solutions can detect and prevent fraudulent transactions done on the blockchain. Crypto exchanges, as well as law enforcement agencies, can use their tools to detect suspicious transactions and track down stolen funds.

- CipherTrace: One company that provides solutions to monitor cryptocurrency transactions using artificial intelligence is CipherTrace. Their software can identify fraudulent activities like market manipulation, money laundering, and more.

- SentinelOne: SentinelOne is an AI-driven cybersecurity firm that has created solutions to detect and stop phishing attempts on cryptocurrency wallets and exchanges.

These businesses are doing their part to make the cryptocurrency industry a more secure place for everyone by utilizing AI.

Market Analysis And Prediction:

Volatility And The Prediction Puzzle

The cryptocurrency market is notoriously volatile, with large price changes occurring frequently and in relatively short periods. Investors may experience a mix of excitement and fear due to this natural volatility. Cryptocurrency values are influenced by a myriad of factors, unlike traditional assets that are driven by established regulations and fundamentals:

Market Sentiment: The price of the cryptocurrency can be greatly affected by the news, the excitement on social media, and the confidence of investors. While a governmental crackdown can cause a market crash, a good tweet by a celebrity can cause prices to skyrocket.

Trading Volume: The number of trades between buyers and sellers has a direct impact on market pricing. Prices tend to be relatively stable when trade volume is low, but they might change wildly when volume is high.

Technology Advancements: Changes in the blockchain ecosystem or other areas of technology might affect how people view cryptocurrencies and their growth potential.

Regulations And Policies: Government policies and regulations have the potential to influence investor confidence, which in turn can cause price volatility due to the resulting uncertainty.

Even seasoned financial professionals find it incredibly difficult to predict the future price of a certain cryptocurrency. This is because of the many dynamic elements that impact market fluctuations, as well as the intrinsic volatility of the market itself. It can be difficult for conventional technical analysis methods to grasp the peculiarities of the cryptocurrency market, which are based on patterns in chart data and past prices.

The Use Of AI To Reveal Crypto’s Hidden Patterns

Amidst the obstacles, artificial intelligence algorithms are providing a ray of hope for cryptocurrency price prediction. Let me show you:

- Big Data Analysis: Algorithms powered by artificial intelligence can sift through mountains of data, such as past price fluctuations, sentiment on social media, news stories, and trading records. Because of this, they are able to spot connections and patterns that human analysts would miss.

- Machine learning and deep learning: Such cutting-edge AI methods can make predictions about future price movements by analyzing past data and current market trends.

- Market Analysis in Real-Time: Because AI algorithms are able to process data in real time, they can respond to changes in the market and news stories far faster than humans can. In order to spot possible trading opportunities, this can be quite important.

Having said that, keep in mind that AI-based price projections can still fail. Important caveats to bear in mind:

- Unanticipated Occurrences: Even the most advanced AI model can be fooled by black swan events, unanticipated news, or abrupt changes in regulations.

- Self-fulfilling prophecies: forecasts made by AI that receive a lot of attention can sway investor behavior, which in turn could lead to the projected price movement happening.

- The “Garbage In, Garbage Out” Principle: High-quality data used to train AI models is crucial to the accuracy of their predictions. Misleading predictions can be made with inaccurate or inadequate data.

AI Is Just A Tool, Not A Prediction Model

Insights provided by AI have the potential to assist in forecasting the future pricing of cryptocurrencies. However, a fair dosage of skepticism is essential when dealing with AI forecasts. You shouldn’t use these algorithms as a crystal ball, but they are strong tools nonetheless. Never make an investment based only on AI forecasts; instead, utilize them in conjunction with other types of market research.

Portfolio Management:

Efficiently Managing Your Crypto Portfolio with the Help of AI

Successfully managing your investments in the ever-changing cryptocurrency market can be a daunting task. The cryptocurrency market is unlike any other, lacking standardization and easily accessible statistics. The intricacies of managing a crypto portfolio are as follows:

A Diverse Scenery: There are thousands of cryptocurrencies out there, making it difficult for investors to narrow down their options to a manageable number and construct a diversified portfolio that meets their needs and ambitions.

Forever Volatility: To manage positions and reduce risk, active management, and continuous monitoring are required due to the intrinsic volatility of the cryptocurrency market.

Requires Technical Knowledge: For first-time investors, it could be difficult to grasp the concept of blockchain technology and how various cryptocurrencies work.

Tools driven by artificial intelligence are quickly becoming indispensable companions in overcoming these challenges. AI can help crypto investors in the following ways:

Risk analysis: AI algorithms can evaluate the risk profile of various crypto assets by analyzing market patterns and historical data. By weighing the prospective rewards against their risk tolerance, investors may make educated decisions about the allocation of capital to each cryptocurrency.

Tailored Investment Plans: Artificial intelligence systems can tailor investment plans to each client by considering their unique risk tolerance, long-term financial objectives, and investment horizon. The AI can then use this information to propose individual investment plans, outlining which cryptocurrencies to buy and what percentage to put toward each.

Integrated Portfolio Management: A number of AI-driven solutions provide integrated portfolio management capabilities. Market circumstances, pre-set triggers, as well as risk management tactics inform the AI’s automatic portfolio adjustments, which investors can control.

Although AI tools provide many benefits, you should never forget that you are the one who must bear the final responsibility for your investing choices. This is why it’s critical for users to exercise caution and engage in responsible investing practices:

AI Is Not 100%: AI forecasts aren’t 100% accurate. Even now, losses are possible due to unforeseen circumstances and market swings.

Grasping the Foundational Assets: You should know the ins and outs of the technology, purpose, and hazards associated with any cryptocurrency you’re considering investing in. Perform your own research; don’t depend only on AI recommendations.

Establishing Definite Limits: Make sure you specify your risk tolerance and investment objectives precisely within the parameters of the AI-powered automated portfolio management system.

Crypto investors may better manage their portfolios, understand the market’s complexities, and maybe reach their financial goals by using AI technologies properly and keeping a healthy dosage of skepticism.

Enhanced Security:

The fundamental decentralization of cryptocurrency offers undeniable advantages, yet it also poses a unique challenge: security. Unlike conventional financial institutions that have strong security measures and regulatory supervision, crypto assets are vulnerable to attempts of hacking and fraudulent activities. This highlights the essential requirement for strong safety precautions in the cryptocurrency industry.

AI plays a crucial role in assisting the creation of advanced security measures to safeguard crypto wallets or exchanges against malicious individuals. AI is transforming crypto security in the following ways:

Anomaly detection: AI systems can monitor user behavior and transaction patterns continuously. This enables the detection of abnormal activities that diverge from the usual pattern, potentially suggesting unauthorized attempts to gain access or questionable transactions.

Methods Of Authentication: AI can improve traditional methods of authentication by integrating behavioral biometrics, resulting in multi-layered authentication. This is looking beyond passwords and login credentials to confirm a user’s identity by examining typing dynamics, mouse movements, and user interaction patterns.

Predictive Threat Analysis: AI can utilize historical attack data to identify emerging threats and forecast potential security vulnerabilities before exploiting. By adopting a proactive approach, developers can effectively implement security precautions and consistently stay ahead of ever-changing cyber threats.

Multiple companies are currently utilizing artificial intelligence (AI) to ensure the security of the cryptocurrency industry.

Gemini: Gemini is a cryptocurrency exchange that uses artificial intelligence (AI) to detect unusual patterns in user behavior and identify potentially suspicious activity.

DeepVault: DeepVault provides advanced security solutions for cryptocurrency wallets, utilizing artificial intelligence technology. Their solutions incorporate facial recognition along with behavioral biometrics to enable multi-factor authentication.

![]()

CipherTrace: CipherTrace is a company that offers transaction monitoring solutions powered by artificial intelligence. These solutions assist cryptocurrency exchanges in detecting and preventing money laundering and other forms of fraudulent activities.

By incorporating artificial intelligence (AI) into their security systems, crypto wallets and exchanges can greatly strengthen their protection against cyberattacks. This will help ensure the safety of user assets and promote a more reliable and secure cryptocurrency ecosystem.

The Future of Crypto and AI:

It is believed that greater possibilities will be unlocked when AI and crypto keep on evolving and fusing. Some current tendencies and possible future uses of AI in the cryptocurrency industry are as follows:

Marketplaces For Decentralized AI:

At present, cloud computing resources are frequently relied upon by AI developers. To promote more open and equitable access to AI resources, decentralized AI marketplaces seek to establish peer-to-peer networks wherein users can lease their computers for AI training and tasks.

Oracles Powered By AI:

Smart contracts, which are blockchain-based agreements that execute themselves, depend on external data feeds (oracles) for their operation. Smart contracts rely on precise and reliable data, which oracles powered by AI can filter and verify. This allows for more complicated and trustworthy applications.

AI-Powered Personalized Investment Advisors:

Soon, people will be able to work with investment advisors powered by AI that are designed to meet their unique needs. To offer individualized investment advice and make automatic choices according to user-defined criteria, these AI tools could examine user risk profiles, investing objectives, and market trends.

Potential Challenges And Considerations Regarding AI And Crypto Integration

As fascinating as AI’s potential is for the cryptocurrency industry, there are some obstacles that must be addressed:

- Discrimination And Bias: algorithms trained on biased data may produce biased results in areas such as investment or as loan approvals.

- Anonymity: Some AI models’ inner workings are not publicly available, which makes people wonder how fair and accountable they are.

- Security And Privacy Of User Data: When integrating AI, big amounts of user data are typically accessed, which can lead to worries regarding data breaches and misuse.

- Hacking:Hacking or manipulation of AI systems themselves poses a security risk, which could compromise user assets or disrupt market activity.

- Education And Accessibility: People without a lot of technical knowledge may have a hard time using AI tools, which could make existing inequalities worse.

To make the impact of AI on the cryptocurrency good for humans and o ensure responsible innovation, it is essential to establish transparent rules and ethical guidelines for artificial intelligence (AI) research, development, and implementation in the cryptocurrency industry. To make sure that the crypto ecosystem can use AI for good in the future, a future that is safe, fair, and inclusive, we must solve these problems through constant study, cooperation, and responsible development practices.

Conclusion:

The impact of AI on cryptocurrency is undeniable. The advent of AI has brought about a sea change in the cryptocurrency market by addressing long-standing problems. Artificial intelligence (AI) is showing to be an invaluable tool for businesses and investors in many ways, including the fight against fraud, the improvement of security measures, the simplification of portfolio management, and the possibility of trend prediction in the market.

In the world of cryptocurrency, using AI technology has changed how people trade. It combines advanced computer programs with the decentralized nature of cryptocurrencies. This mix creates many chances for those who are open to trying new things. Alongside this, joining crypto signals telegram groups that share crypto signals can also help you make money. These groups offer real-time advice and tips from experts. They can guide you to make smart choices and possibly earn more in cryptocurrency trading.

The potential for AI to completely transform the cryptocurrency industry is evident, even though there are still obstacles to overcome, such as ethical concerns, data privacy, and accessibility. By keeping up with the latest developments and encouraging responsible development, we can make sure that AI helps make the future of the crypto ecosystem safer, more efficient, and easier to access.

We expect this dynamic partnership between AI and crypto to change the financial landscape in the future, so we encourage readers to keep exploring the ever-evolving relationship.