According to sources, an increasing number of Chinese semiconductor design businesses are turning to Malaysian enterprises to construct a portion of their high-end chips to hedge risks if the U.S. expands restrictions on China’s chip industry.

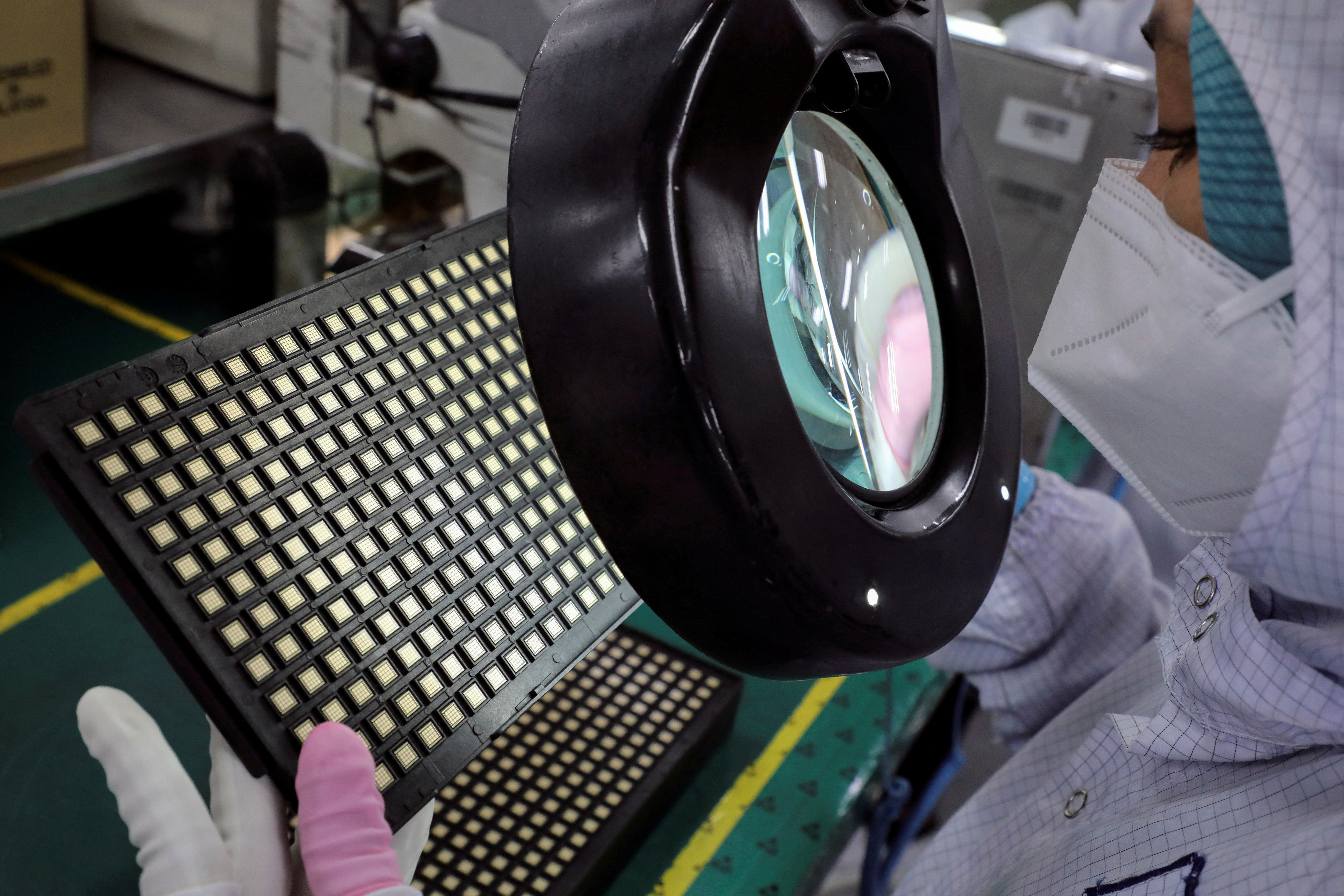

Three sources familiar with the matter have revealed that the businesses are requesting that chip packaging manufacturers in Malaysia manufacture GPUs. According to them, the requests solely include assembly, which does not violate any U.S. regulations, and not chip wafer manufacture. Two of the participants added that certain contracts had already been agreed upon. The individuals refused to be identified or share the names of the companies involved, citing confidentiality agreements.

The U.S. government has been cracking down on sales of high-end graphics processing units (GPUs) and other advanced chip-making equipment to curb China’s access to these technologies, which might power A.I. advancements, supercomputers, and military deployments. Analysts have noted that small Chinese semiconductor design companies face challenges in securing advanced packaging services domestically due to the impact of sanctions and the surge in demand caused by artificial intelligence.

According to two sources, certain Chinese corporations are interested in modern semiconductor packaging services. The semiconductor industry is quickly recognizing advanced chip packaging as a crucial technology that may greatly enhance chip performance. This can include the creation of chiplets, which are tightly packed chips that function together as a single powerful brain. Although not subject to U.S. export controls, it is an area that can necessitate sophisticated technology, which the corporations fear may one day be targeted for export restrictions to China, according to the two sources.

Malaysia, a significant semiconductor supply chain center, is considered as well-positioned to capture additional business as Chinese chip makers diversify their assembly needs outside of China. One source briefed on the situation stated that Chinese clients have been more interested in doing business with Unisem (UNSM.KL), which is majority owned by Huatian Technology (002185. S.Z.) of China, and other chip packaging companies in Malaysia.

Unisem Chairman John Chia declined to comment on the company’s clients. Still, he did say that “due to trade sanctions and supply chain issues, many Chinese chip design houses have come to Malaysia to establish additional sources of supply outside of China to support their business in and out of China.”

According to two sources, Chinese chip design firms regard Malaysia as a good alternative because the country appears to be on pleasant terms with China, is cost-effective, has an experienced workforce, and sophisticated equipment.

When asked if taking contracts to build GPUs from Chinese enterprises may elicit U.S. retaliation, Chia said Unisem’s business activities were “fully legitimate and compliant,” and the company didn’t have time to worry about “too many possibilities.” He mentioned that the majority of Unisem’s Malaysian customers were from the USA.

Some more major chip packaging companies in Malaysia include Inari Amertron and Malaysian Pacific Industries (MPIM.KL). They didn’t reply to it. According to a source who invested in two Chinese semiconductor startups, Chinese corporations are considering outsourcing chip assembly to countries outside of China. This move could ease their product sales in non-Chinese markets.

Malaysia As A MAJOR Hub:

Malaysia presently accounts for 13% of the worldwide semiconductors, assembly, packaging, and testing market and hopes to increase that to 15% by 2030.

Ex-Huawei subsidiary Xfusion announced in September that it would collaborate with Malaysian firm NationGate to produce graphics processing unit (GPU) servers for data centers; these servers are utilized in artificial intelligence (A.I.) and high-performance computing. Other Chinese chip firms have also announced intentions to expand in Malaysia.

StarFive, headquartered in Shanghai, is also constructing a design center in Penang. In a joint venture with American chipmaker AMD, TongFu Microelectronics announced last year that it will expand its Malaysian factory. Malaysia has lured multibillion-dollar semiconductor investments by offering a variety of incentives. In August, Infineon, a German semiconductor manufacturer, announced plans to expand its facility there, spending 5 billion euros, or about $5.4 billion.

Intel of the United States stated in 2021 that the corporation would develop a $7 billion sophisticated chip packaging facility in Malaysia. Chinese firms are also choosing Malaysia. One of the biggest companies in the world that tests and puts together chips, JCET Group, bought an advanced testing center in Singapore in 2021.

Other nations, including Vietnam and India, are also looking to develop their chip manufacturing capabilities to attract clients who want to reduce US-China geopolitical risks.