When did you first hear about this weird phenomenon known as “The Cloud“? Most likely, it happened around the 2010s. Many predicted that it would be extremely beneficial for tech companies, and they were not wrong.

From $31 billion in 2015 to about $200 billion in 2023, expenditures were incurred on public cloud usage. With yearly run rates of more than $100 billion apiece, Amazon’s Amazon Web Services (AWS) and Microsoft’s Intelligent Cloud offer fantastic revenue streams. Since 2015, the two stocks’ combined returns have increased by nearly 900%, appreciations primarily due to this technology.

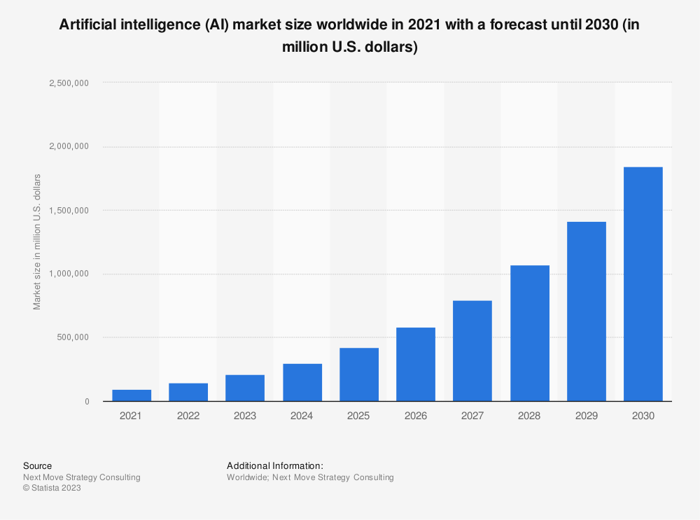

AI (artificial intelligence) is the newest and greatest thing. It’s predicted by some to be just as revolutionary as the internet. According to data published by Statista, the AI market is expected to grow six times from $300 billion this year to over $1.8 trillion by 2030. The International Monetary Fund predicts that AI will affect about 40% of jobs globally.

These four businesses might be a huge source of joy for investors over the next six years as they capitalize on the expansion of artificial intelligence.

Palantir

Palantir is a popular stock, and a lot of the hype around it is well-founded. The core of its operations is the administration, evaluation, and use of data to enhance the efficiency of decision-making procedures. Furthermore, its platforms enable the private sector and governments to apply AI for this purpose.

Palantir’s latest solution, Artificial Intelligence Platform (AIP), is intended for both the defense and commercial sectors and uses large language models (LLMs). AIP is deployed on the customer’s network. What does this precisely mean? An example from Palantir is this.

Put yourself in the shoes of a military operator commanding forces on the ground. The enemy is assembling equipment nearby, according to intelligence you have received. The operator’s field of view allows questions like “What enemy units are nearby?” and “What are likely enemy formations?” to be asked. After that, they might direct satellites or drones to take images. By employing this technology, the operator can make more informed planning and operating decisions.

Palantir has demonstrated success in managing the defense budget in the past. Governments have huge budgets, so this is a great way to raise money. Nevertheless, there is a substantial market offered by the private sector.

The corporation had an 11% increase in government revenue to $324 million in the fourth quarter of 2023, while commercial revenue jumped by 32% year over year (YOY) to $284 million (accelerating from the 23% YOY growth in Q3). Using generally accepted accounting rules (GAAP), Palantir was profitable for the fifth consecutive quarter. It is a remarkable achievement for a rapidly expanding digital company.

The stock is not inexpensive. It is trading at 25 times sales, but this decreases to 20 on a forward basis when taking sales forecasts into account. There is a short-term danger due to the valuation, so consider purchasing over time. Palantir has outstanding long-term AI credentials.

UiPath

It would help if you started using the term robotic process automation (RPA) in your lexicon. With this, boring, non-value-adding jobs are automated.

A mortgage broker, for instance, would put in hours going through correspondence, downloading files, and physically inputting information into forms. It can be automated with RPA, allowing the broker to concentrate on more important duties like interacting with underwriters and contacting clients. Here’s an illustration of what UiPath (NYSE: PATH) may accomplish for its clients.

UiPath has around 10,800 clients, and their yearly recurring revenue (ARR) is $1.4 billion. In the third quarter of UiPath’s fiscal 2024 (the three months ended October 31, 2023), sales were $326 million, a 24% growth rate that is remarkable given the difficult economic conditions in 2023. Additionally, with $1.8 billion in cash and investments and no long-term debt, UiPath’s financial sheet resembles a fortress.

In a fragmented sector, UiPath faces intense competition, which could be the biggest risk for investors. Despite being cash-flow positive, the company is not GAAP profitable. For the industry, the stock trades at 11 times sales, which is fair.

By automating humble operations, RPA has the potential to save businesses enormous sums of money, and UiPath may stand to gain a lot from this development in the long run.

Evolve Technologies

Please take note that this stock is more speculative than others before I get too deep into the company. Its market valuation is less than $1 billion. Because risk management is so important, the percentage of your portfolio that should be made up of speculative equities should depend on your age, risk tolerance, and the amount of time you have to make up losses. In light of this, Evolv Technologies offers amazing technology that has the potential to save your life and bring in large sums of money for investors.

Nowadays, customers must wait in queue to pass through a metal detector one at a time, remove their pockets, and frequently receive a second screening using a wand before entering a stadium or other event. It could be more effective, and things are frequently overlooked.

The technology used by Evolv is unique. The AI-powered devices allow many persons to pass through them. Instead of warning for anything metallic, like car keys, the detectors check for different features, such as shapes, to identify weapons like knives or guns. Security professionals take action after receiving alerts that indicate the location of the discovered object.

Stadiums, hospitals, and schools are among Evolv’s target markets. Schools, medical institutions, and several professional sports teams currently use it. With a 129% year-over-year surge in ending annual revenue of $66 million in Q3 2023, subscriptions increased 137% to a little over 4,000. Evolve, which has a $676 million market capitalization and tonnes of potential, trades at a fair 10 times ARR.

Amazon

You may not be familiar with all of the companies mentioned in this article before, but it probably is different from this one. Although Amazon is best known for its online store, the world’s top cloud service provider, AWS, will also greatly benefit from AI.

A large amount of the data needed by AI software will be processed in the cloud. Aside from foundational models, which let users customize AI software to their specifications, Amazon also provides other AI solutions.

Amazon recently disclosed its Q4 2023 earnings, and they were extremely impressive. Along with notable gains in operating income and cash flow, total sales increased by 14% to $170 billion. Based on sales and cash flow, as shown below, the stock increased but is still trading below its five-year average.

AI will provide Amazon with a boost that will satisfy investors going forward.