Is all the excitement appropriate? Investors need to ask themselves this concern frequently when the next big thing sparks an upsurge in buying and accelerates some companies to unprecedented levels.

Artificial intelligence (AI) allows us to watch this unfold in real-time. The excitement surrounding AI’s potential for certain businesses has occasionally gotten out of control. However, that is only sometimes the case. These are the top three AI stocks for an immediate purchase in April.

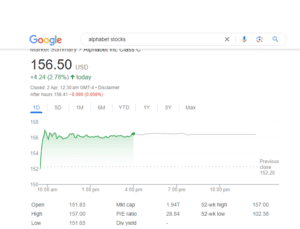

1. Alphabet

Is Alphabet a champion in AI? Yes. Investor attention has primarily been drawn to the internet giant’s errors, such as the scandal involving Google Gemini producing false historical photographs. Still, Alphabet’s broader artificial intelligence narrative is a positive one.

Regardless of the PR errors, Apple is apparently discussing integrating Gemini into iPhones with Alphabet for a reason. The AI model is incredibly potent. More importantly, this is only the first edition.

Alphabet might gain anything extra from a merger with Apple. Getting such well-known support for Gemini will help Google Cloud draw in more clients. Gemini and the cloud platform are closely linked.

Alphabet’s other main AI concentration isn’t receiving the attention it merits. Waymo, a company that develops self-driving cars, already offers automated ride-hailing (robotaxi) applications in San Francisco and Phoenix. Austin and Los Angeles are next on the list.

According to Cathie Wood of Ark Invest, Robotaxi sales are expected to reach a value of ten trillion dollars by the beginning of the next decade. Waymo is well-positioned to take a sizable share of this industry.

-

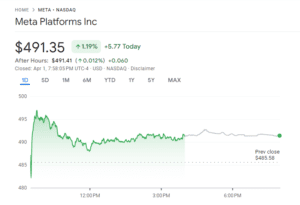

Networks of Meta

Not too long ago, many investors thought Meta Platforms was a thing of the past. I doubt that anyone today views things this way. The price of Meta stock has increased by about 140% in the past 12 months.

The ambition of Meta’s AI plan was made clear by President Mark Zuckerberg during the company’s fourth-quarter business statement last month. According to him, Meta is developing artificial general intelligence (AGI), or “complete general intelligence.” If the plans are successful, the business’s situation will drastically alter.

However, Meta can succeed in the AI space without AGI. The business is already utilizing AI to boost revenue on social media platforms. It has high standards for corporate messaging driven by artificial intelligence. With thousands of millions of users interacting using its artificial intelligence systems, Meta can quickly advance its innovations and receive feedback right away.

About the enormous user base, in the last quarter of 2023, nearly 3.2 billion individuals globally used Meta’s applications daily. Earnings from advertising are increasing, but spending as a share of income is decreasing. This results in more profitability and more funds available for expansion projects in the future.

-

The iPath

UiPath is an excellent choice if you’re searching for an artificial intelligence investment that could be more well-known. This business is a component of “artificial intelligence sleeping raise,” according to Ark Invest.

UiPath sells the top RPA (robot process automation) platform. AI is used by the technology behind it to automate almost any digital operation. Worldwide, UiPath has produced over 15,000 robots that are currently in manufacturing. With Autopilot, the organization’s latest tool, consumers can employ generative AI to automate operations.

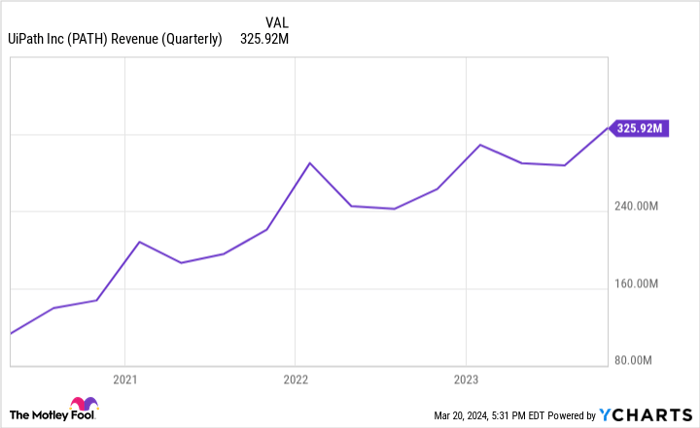

It is undoubtedly a growing industry. UiPath saw record revenue in Q4, increasing 31% over the previous year to $405 million. Record cash flow was reported by it. Additionally, the business made a profit in its very first instance.

According to a recent study, 70% of business executives think that AI-powered automation is “extremely vital or critical” to achieving the objectives they set for themselves and expect UiPath to maintain its robust growth trend.