The widespread use of AI has enhanced productivity in many different fields. Despite the AI stock market’s recent surge, many individual investors are unable to afford the $100+ share prices of large-cap artificial intelligence companies such as Nvidia, Google, and Microsoft.

Lucky for you, you can get a piece of this fast-growing business by investing in small-cap AI Stocks under $10 per share. Investing in these inexpensive AI stocks is one way to profit from AI growth without going into debt.

14 AI Stocks under $10 In 2024:

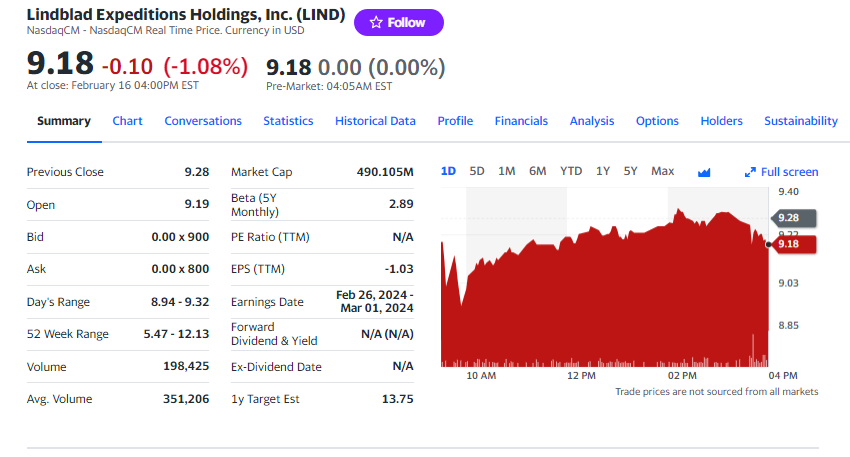

1. Lindblad Expeditions:

Across all seven continents, Lindblad Expeditions offers ecological cruises and land experiences. Unlike other cruise lines, its 16 ships can accommodate smaller groups of up to 148 passengers.

Brainy Insights estimates that the adventure tourism industry will expand from its 2022 valuation of $295.37 billion to a 2032 valuation of $1.49 trillion, a CAGR (compound annual growth rate) of 17.56%.

With a standard cost of $14,000 per person, Lindblad Cruises achieves astonishingly high profits. The company’s third-quarter sales were $176 million, an increase of 22% year over year, while earnings per share were $0.08, down from $0.18 in the same quarter last year. When comparing 2019 to 2023, Lindblad had a 42% increase in bookings. This AI share price is $9.24.

2. Ceragon Networks:

This is the Most Affordable Connectivity Stock Under $10. It manufactures the gear that businesses rely on for their wireless networks, including antennas, base stations, and radios, and the technology that enables data, video, and audio to move via radio waves over great distances.

Ceragon’s expected revenue for 2024 is projected to be between $385 million and $405 million, reflecting a midpoint rise of 14%. Results for Ceragon’s third quarter were up 10.9% year over year at $87.3 million in sales and $0.04 in earnings per share compared to a loss of $0.01 in the identical period last year.

Ceragon seems to have found some success since it has posted three straight quarters of profitability. With the acquisition of Siklu, Ceragon has access to private networks and smaller service providers in the US market, among other benefits. Its share price is $2.49.

3. AudioEye (AEYE)

AudioEye is a company that helps websites and applications adapt to different screen sizes so they can comply with regulations that protect people with disabilities. The undeveloped market that AudioEye is targeting has exponential development potential and already has over 80,000 clients. Its share price is $5.7.

4. The DUOT Group of Companies

When it comes to protecting America’s vital infrastructure, no artificial intelligence (AI) firm does it better than Duos Technologies. Its intellectual property holdings are substantial, and it provides portal technology for AI-powered rail inspections. Duos Technologies is a leading AI company positioned for long-term expansion by concentrating on rail transportation. Its share price is $3.78.

5. INOD (Innodata)

Innodata is an industry-leading data engineering firm that uses AI and ML to address difficult data problems. To put it simply, it aids clients in creating data-driven marketing strategies that work. As a pure-play AI stock, Innodata is extremely undervalued, with a market size of less than $200 million and a stock price below $10. It has enormous upside potential and earns its position in AI Stocks under $10 list.

6. CooTek (CTK)

The Chinese online startup CooTek is all about artificial intelligence and machine learning. Fitness, literature, and casual gaming are just a few of the categories represented in its app store. Investing in CooTek’s artificial intelligence (AI) could not be more economical, with a market cap of less than $50 million and below $1 per share.

7. Remark Holdings (MARK)

The retail, banking, and entertainment sectors are among those that Remark Holdings targets with its artificial intelligence solutions. In addition, it runs a digital media company that helps with marketing campaigns that use AI. Considering the stock’s recent decline from its 2021 highs, Remark Holdings presents a compelling opportunity to enter the market. Its share price is $0.48.

8. Alithya Group (ALYA)

Alithya Group offers artificial intelligence (AI) solutions and digital transformation services to industries including healthcare, manufacturing, and finance. Alithya is well-positioned for strong long-term growth thanks to its wide customer base and activities across North America and Europe. Its share price is $1.48.

9. Amesite (AMST)

Amesite provides tailored online courses powered by artificial intelligence to companies, colleges, and elementary and secondary schools. Amesite has a great opportunity to profit from the rising demand for online education. Its share price is $2.49.

10. Qudian (QD)

Qudian is an AI-powered consumer lending platform in China that uses big data to evaluate risk and score borrowers. It has a good chance of capitalizing on the expanding need for consumer financing solutions in China’s underserved market. Its share price is $2.31.

11. Lantronix (LTRX)

Lantronix provides artificial intelligence (AI) solutions for the Internet of Things (IoT) and edge computing, which improve the safety, efficiency, and usability of electronic systems. With its emphasis on the Internet of Things (IoT), Lantronix stands to gain substantially from the current upsurge in IoT usage. Its share price is $3.88.

12. Infobird (IFBD)

Infobird is a Chinese SaaS provider that specializes in artificial intelligence (AI) customer service solutions for sectors like healthcare, education, and finance. The Chinese SaaS industry is huge and mostly unexplored, which bodes well for Infobird’s future growth. Its share price is $0.82.

13. Ideanomics (IDEX)

The electrification of vehicles and financial technology services are the main areas of interest at Ideanomics. Ideanomics’ electric vehicle (EV) infrastructure and operation support services are well-positioned for expansion, thanks to the rising demand for EVs. Its share price is $1.04.

14. Recore Systems (REKR)

Recore uses artificial intelligence to revolutionize data and administration of public transportation systems. Recore has a lot of space to grow since smart mobility solutions are in demand. Its share price is $2.47.

Ultimately, if you’re looking for a cheap way to get in on the AI megatrend, These AI Stocks under $10 are a great bet. Leading AI inventors such as Duos Technologies, Innodata, and CooTek have the potential to provide significant profits at their current valuations. These stocks should be added to the watchlist of investors seeking cheap long-term AI investments.

Why You Should Invest Money In AI Stocks Under $10?

The dangers and potential benefits of investing in AI Stocks under $10 are worth considering. Throughout the world, people are finding that AI is a great sector that simplifies their lives. As we enter the year 2024, advancements in artificial intelligence (AI) are happening at a rate no one has ever seen before, and investors should be optimistic about the future of AI stocks. How AI will evolve in the future, why AI Stocks under $10 is a good investment, and what more the exciting field of artificial intelligence has in store are all topics that are covered in this article.

The Ascendance of AI Developments

Incredible progress is being made in AI across several domains, including computer vision and natural language processing. Artificial intelligence (AI) is having a significant impact on several sectors, including healthcare, banking, and communication, as technology keeps becoming better and better.

Where AI Is Headed:

Artificial intelligence is a transformative revolution that is surpassing mere technological trends and is impacting industries on an international scale. Across several industries, including healthcare and finance, AI is revolutionizing processes, increasing efficiency, and boosting production. Progress in artificial intelligence (AI) is on the verge of reshaping our daily lives, workplaces, and social interactions, thanks to developments in machine learning, NLP, and robots.

Investment For Life:

If you want to invest in the future rather than merely the present, buy AI Stocks under $10. Businesses that can tap into the possibilities presented by AI will be well-positioned for the future as this technology permeates all aspects of human life. When people put their money into AI stocks, they are joining a revolutionary movement that will affect how society and technology develop in the years to come.

Final Thoughts:

Growth and access to the AI sector are possible with investments in the top AI Stocks under $10. Seek out startups that show promise, have cutting-edge AI solutions, strong foundations, and room to develop. To make the most of the prospects that these easily accessible assets provide, thorough study and diversification are essential.