The companies, Microsoft Corporation, Alphabet Inc., Google, and Advanced Micro Devices, are working harder than nearly anyone to incorporate artificial intelligence into their products. They discover that living up to investor expectations for the technology is challenging.

Following their estimates for the current quarter and their results for the final three months of 2023, the tech giant’s shares fell in late trade on Tuesday. Each of the three worked hard to showcase advancements in AI. In AMD’s example, the business estimated that sales of its new AI chips would exceed initial projections. Google claimed the technology enhanced its cloud computing and search services, while Microsoft boasted about how people were adopting its AI helpers.

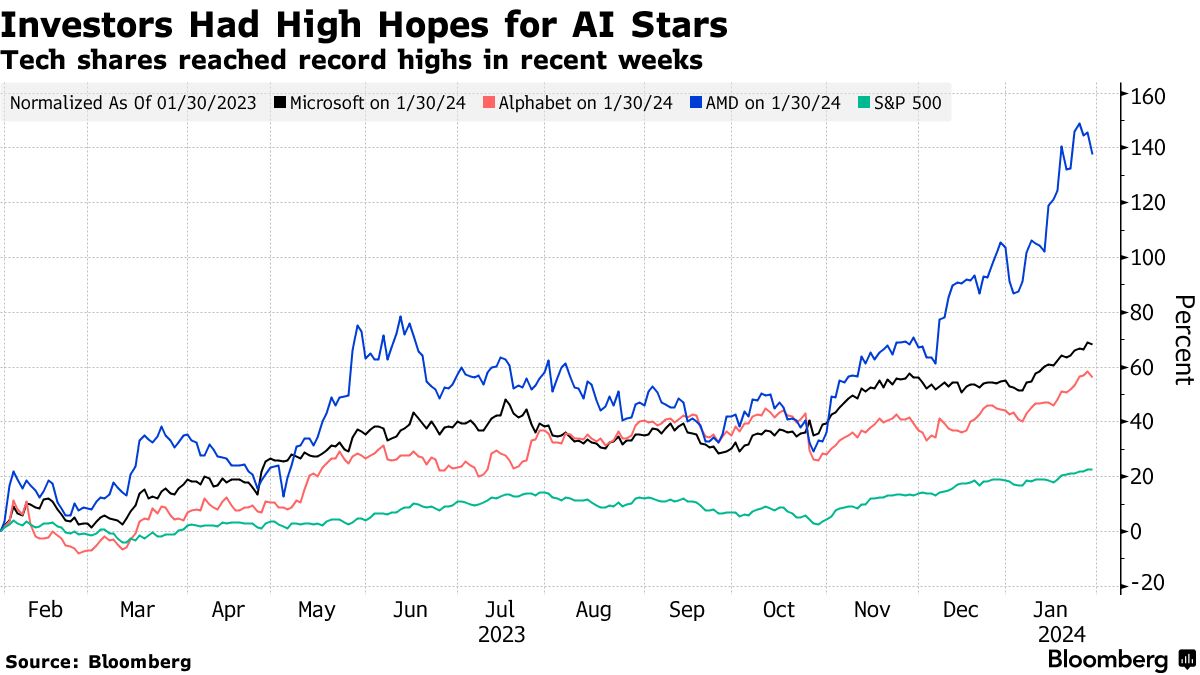

However, investors had recently moved the companies’ shares to all-time highs, wagering that an AI crash would push outcomes rapidly. They wanted more from what they heard on Tuesday.

According to Katrina Dudley, a portfolio manager and analyst at Franklin Templeton, who made this statement on Bloomberg Television, businesses must continually establish their worth and the benefits of artificial intelligence.

The findings from Microsoft and Google, two competitors in AI software and cloud computing, were largely positive, but investors needed to be more impressed.

Microsoft’s revenue has increased since 2022, partly due to its data center services being driven by AI technologies. Its Azure cloud services division saw a 30% increase in revenue.

According to Chief Financial Officer Amy Hood, that growth rate increased by six percentage points due to demand for AI. During a conference call with business executives, Karl Keirstead, an analyst at UBS Group AG, described the acceleration from 3 percentage points to this amount, calling it “just extraordinary.” Microsoft did not say how much AI is planned to support Azure going forward.

The momentum did not stop Microsoft shares from falling in late trading. According to CFRA Research analyst Angelo Zino, Wall Street wants more excellent information on the extent to which AI will impact financial performance in the future. “Over the next few years, investors want them to quantify the AI prospect,” he stated.

However, Microsoft will not impersonate Nvidia Corporation, a manufacturer of AI processors whose sales have skyrocketed. “That’s not how this will work in terms of AI contribution for Microsoft,” Zino declared. “This will take longer than some might have thought.”

“Much Quicker”

In November, Microsoft introduced 365 Copilot, an AI helper for Office suites including Teams, Word, Excel, and Outlook. The firm did not provide details regarding product subscriptions. Still, Satya Nadella, the CEO, stated during the conference call that the software was being adopted “much faster” than it had been in the past.

Concerns were raised about Google’s weakening in its core search advertising business. However, its quarterly report also raised concerns about whether it is pursuing AI aggressively enough and running the risk of lagging behind Microsoft.

According to Evelyn Mitchell-Wolf, an analyst at Insider Intelligence, the company’s primary source of revenue, its ad business, might slow down, endangering its aspirations in AI.

She said that Google advertisements account for most of its income. Having that currency cow experience volatility doesn’t predict well as it qualifies to go full throttle on all of its carefully applied plans in AI.

AMD’s new chip

When investing in AI computing, investors had long favored AMD’s stock. After exhibiting a comparable return in 2023, its shares have been the second-best-performing company on the Philadelphia Exchange Semiconductor Index this year. It implied that AMD had a difficult task to accomplish with its quarterly report. The fact that the chipmaker’s sales prediction for the current quarter fell short of most projections did not help either. However, the business reported that its considerably higher-than-anticipated MI300 AI accelerator chip sales are being generated.

Like Nvidia’s well-known H100 processor, the processor helps develop AI models by inundating them with data. The product is in such high demand that AMD has raised its sales projection this year from $2 billion to over $3.5 billion.

The catch

According to Chris Caso, an analyst at Wolfe Research, some Wall Street watchers had been projecting figures as high as $8 billion. In late trading, AMD shares dropped by more than 6%.