The South Korean fabless AI chip firm Rebellions announced today that it has raised $124 million (165 billion KRW) in Series B funding to create Rebel, its third AI chip. The oversubscribed round of funding will allow the business to hire more people and increase production of its Atom processor, which is designed for usage in data centers.

Rebellions’ chief financial officer Sungkyue Shin told TechCrunch in an exclusive interview that the three-year-old firm is valued at around $658 million (880 billion KRW) after this Series B. The amount raised since Rebellions’ beginning in 2020 is roughly $210 million, including this recent cash infusion.

This most recent investment was spearheaded by KT, a strategic investor and South Korean telecom behemoth. In addition to new investors Korelya Capital and DG Daiwa Ventures, the event was also supported by Korea Development Bank and Temasek’s Pavilion Capital.

Rebellions is raising money at a pivotal time in the chip business, particularly regarding artificial intelligence chip development and usage.

When people hear the term “artificial intelligence,” they immediately think of Nvidia, the undisputed leader in the AI chip industry. The success of Nvidia’s ecosystem, which consists of both hardware and software, has been widely noted. For the remainder of the field, though, the game is far from over. People are still rushing to find new and better ways to handle data, and the associated costs are pretty expensive, which is a big problem for AI applications.

Changes are occurring in various directions. Google, Amazon, Apple, and Microsoft are just a few of the tech giants that create or own the processors needed to incorporate artificial intelligence into their offerings. Sam Altman, CEO of Open AI, allegedly met with Samsung and SK Hynix, two of South Korea’s most prominent chip companies, last week. In addition, rumors have it that Open AI is trying to raise billions of dollars to fund the establishment of chip fabrication plants where it intends to manufacture its cognitive chips. Beyond Rebellions, there are a plethora of other firms that are offering novel ideas to enhance processing speed and efficiency.

Rebellions Working With Samsung:

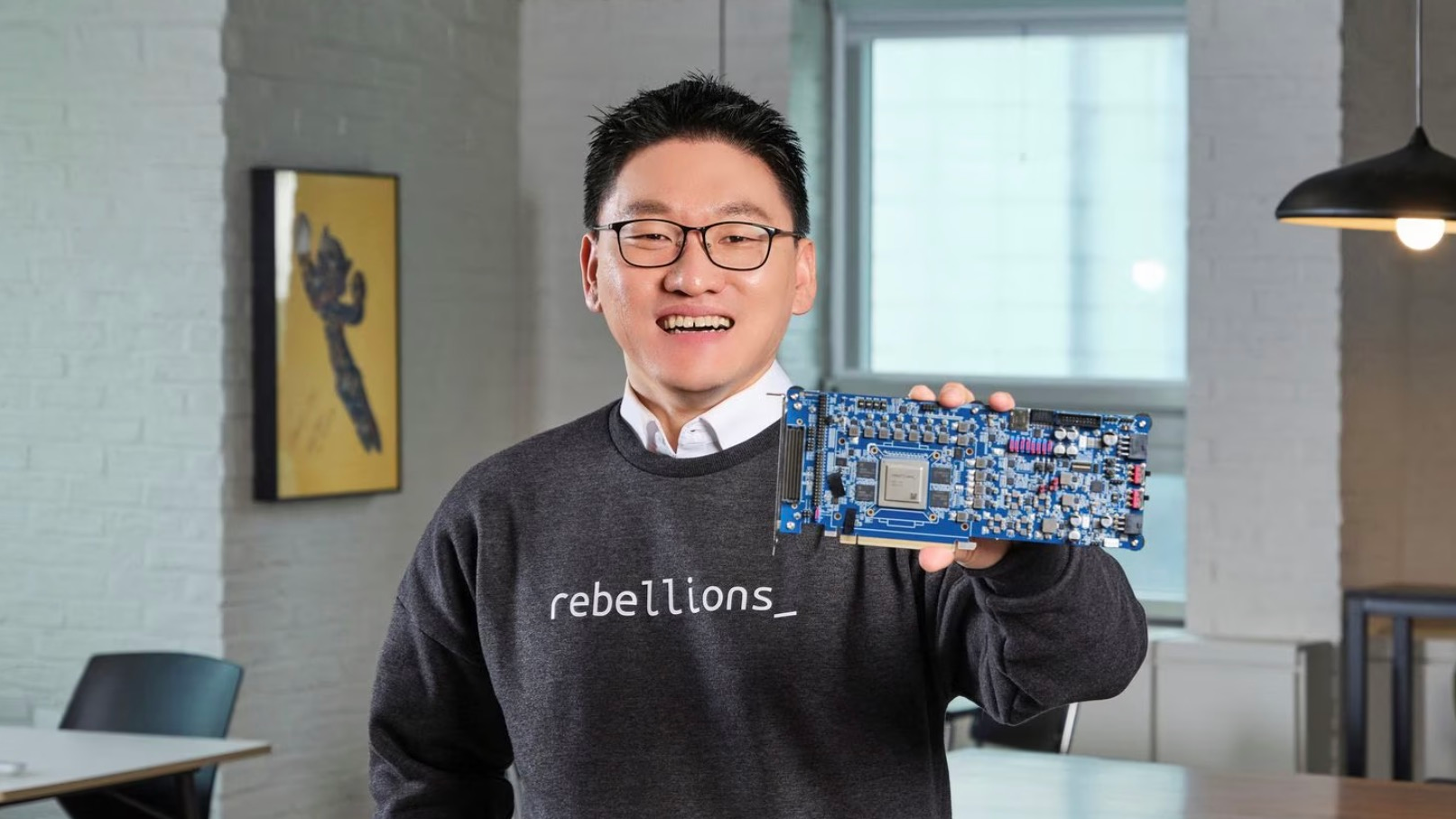

After months of speculation, the startup has finally announced its much-anticipated financing. Continuing a connection that began with Samsung Electronics’ Atoms chips, Rebellions announced in October that the two companies would work together to produce Rebel’s latest chip. Shin announced that the two businesses will begin mass-producing Rebel in 2025 after finishing development by the end of this year. The next-generation AI chip is going to be aimed at the generative AI industry that runs hyperscalers and large language models (LLMs).

According to Shin, who spoke with TechCrunch, Samsung Electronics’ 4-nanometer fabrication process will be utilized by Rebel. The AI chip developed by Rebel will be integrated with Samsung’s HBM3E advanced memory chip technology, which is used to construct and execute big language models and is built to handle high bandwidth memory. Rebellions’ USP is the assertion that its products and technology are more adaptable than bespoke AI processors, allowing them to accommodate a wide range of generative AI models that rely on AI accelerators.

Rebellions and Samsung will work together on everything from co-development and chip design to Rebel mass production, according to the company’s CFO. Samsung is working on this with a second objective in mind: Along with its chip endeavors, Samsung Gauss, the leading memory chip manufacturer in South Korea, has been developing its generative AI model.

ATOM And ION:

It has also been collaborating with clients who are still using chips from earlier generations. The cloud-based neural processing units (NPUs) infrastructure of Rebellions’ strategic investor KT was upgraded in May 2023 with the installation of Atom, the data-center-oriented AI processor developed by Rebellions. According to Rebellions, they anticipate making money off of the Atom chip model in the second half of this year, and they will keep making them using Samsung’s 5-nanometer fabrication method. Rebel is aimed at larger, more complex language models, but Atom is more suited to data centers and models with up to seven billion parameters, as pointed out by Shin.

On the other hand, the startup has not yet secured any commercial customers for its first artificial intelligence chip, Ion, which was introduced in November 2021 and is currently undergoing qualification tests in the US. The business thinks that financial services applications will be a major market for Ion’s edge computing capabilities. More prominent organizations developing their hardware may utilize the chips to power applications that anticipate and trade stocks.

Rebellions was founded in 2020 by four co-founders and CEO Sunghyun Park, who had previously worked as a quant developer at New York’s Morgan Stanley.